1. Single-Member Operating Agreement

A Single-Member Operating Agreement is a legal document specifically designed for a Limited Liability Company (LLC) with only one owner, known as the sole member. This agreement outlines the structure, daily operations, and policies of the LLC. It is essential for providing a clear framework for how the business will be managed and helps establish the LLC as a separate legal entity from its owner, thereby protecting the owner's personal assets from business liabilities.

Key Components:

- Company Information: Name, principal address, and formation date of the LLC.

- Member's Information: Name and address of the sole member.

- Management Structure: Details on how the company will be managed, typically by the sole member.

- Capital Contributions: Outline of the initial capital contributions made by the sole member.

- Distributions: How profits and losses will be distributed to the sole member.

- Meetings and Voting: While not necessary for single-member LLCs, it can outline how decisions are made.

- Dissolution: Procedures for dissolving the LLC.

2. Multi-Member Operating Agreement

A Multi-Member Operating Agreement is a legal document used by an LLC with two or more members. This agreement delineates the rights, responsibilities, and relationships between the members, helping to prevent conflicts and misunderstandings.

Key Components:

- Company Information: Name, principal address, and formation date of the LLC.

- Member Information: Names and addresses of all members.

- Management Structure: Whether the LLC will be member-managed or manager-managed.

- Capital Contributions: Each member's initial contribution and any future contributions.

- Profit and Loss Allocation: How profits and losses will be distributed among members.

- Voting Rights and Decision-Making: Voting procedures and the power of each member.

- Withdrawal and Dissolution: Rules for member withdrawal and dissolution of the LLC.

Single Member LLC Operating Agreement Template in Word Formate

Download

Multi Member LLC Operating Ageement Template in Word Formate

Download

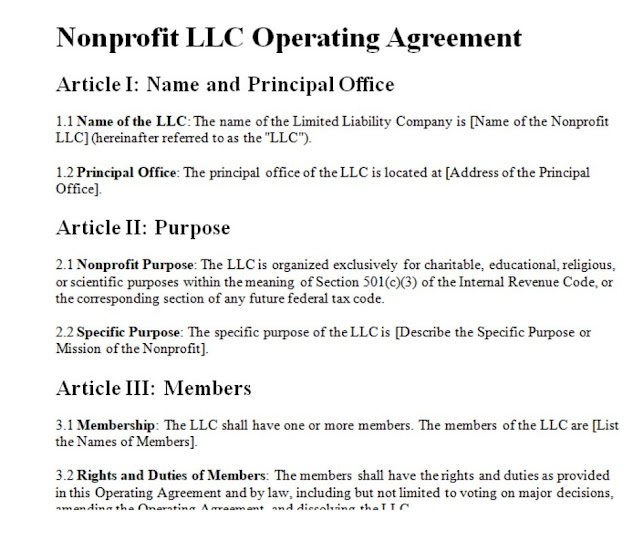

Non Proifle LLC Operating Agreement Template in Word Formate

Download

Series LLC Operating Agreemnt Templates in Word Format

Download

Manager Managed LLC Agreement Template in Word Format

Download

Family Owner LLC Operating Agreement Template in Word Format

Download

3. Legal Definition of an LLC Operating Agreement

An LLC Operating Agreement is a legally binding document that sets forth the internal workings of a Limited Liability Company. It establishes the structure, management, operational guidelines, and financial arrangements of the LLC, functioning similarly to bylaws in a corporation.

Legal Aspects:

- Contractual Agreement: It is a contract among the LLC members.

- State Compliance: While not always required by state law, it is highly recommended as it provides legal protection and clarity.

- Binding Document: Once signed, it is enforceable by law.

4. States Requiring an Operating Agreement

Not all states mandate an operating agreement for LLCs, but it is beneficial regardless of the requirement. Here are some states where it is either required or strongly recommended:

States Requiring an Operating Agreement:

- California: Requires a written operating agreement.

- Delaware: Requires an operating agreement, but it can be written, oral, or implied.

- Maine: Mandates that an LLC has an operating agreement, which can be written or oral.

- Missouri: Requires an operating agreement, though it can be written or oral.

- New York: Requires a written operating agreement to be adopted within 90 days of filing.

5. Financial Activities and Beneficial Ownership Disclosure

Financial Activities within an LLC include the management of income, expenses, and distributions. It outlines how financial transactions are handled, recorded, and reported. Proper documentation ensures transparency and compliance with tax regulations.

Beneficial Ownership Disclosure refers to the requirement for LLCs to disclose information about individuals who have significant control over or ownership in the company. This is aimed at preventing money laundering and enhancing transparency.

Key Points:

- Bank Accounts: Policies for opening and managing bank accounts.

- Accounting Methods: Methods for financial record-keeping and reporting.

- Profit Distribution: Guidelines for distributing profits among members.

- Tax Considerations: Provisions for handling federal, state, and local taxes.

- Beneficial Owners: Identifying and disclosing beneficial owners to regulatory authorities.

6. What to Include in an LLC Operating Agreement

An LLC Operating Agreement should be comprehensive and tailored to the specific needs of the business. Here are essential elements to include:

Essential Elements:

- Basic Information: Name, principal place of business, and purpose of the LLC.

- Member Details: Names, addresses, and ownership percentages of each member.

- Management Structure: Whether the LLC is member-managed or manager-managed.

- Capital Contributions: Initial contributions and future funding requirements.

- Profit and Loss Allocation: How profits and losses are shared among members.

- Voting Rights: Voting procedures and the weight of each member's vote.

- Meetings: Guidelines for holding meetings and making decisions.

- Transfer of Interests: Rules for transferring ownership interests.

- Dissolution Procedures: Steps for dissolving the LLC and distributing assets.

Comments

Post a Comment