Bylaws are important for corporations to establish regulations. They prevent legal or financial issues in the future. Bylaws are instructions created by a corporation's board of directors that outline operational procedures. They vary depending on the corporation's size and type. Bylaws cover the structure, committees, board of directors, officers, shareholders, stock options, and meeting conduct. Bylaws don't need to be reported in most states but should be kept on company premises. Most corporations have both a charter and bylaws. Bylaws are beneficial in most states, even if not required. See the table below for which states require bylaws.

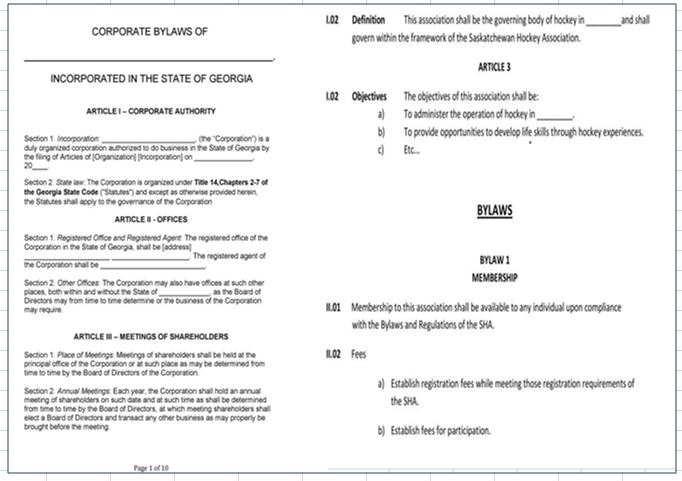

Bylaws Template for PDF

Download Here

Bylaws Template for Non-Profit Organization

Download Here

Bylaws Templates for Friends Group

Download Here

Corporate Bylaws Template for PDF

Download Here

Difference Between Incorporation and Corporate Bylaws?

A corporation's articles of incorporation register the business as a corporation with the Secretary of State. Corporate bylaws serve as an internal guide on how the corporation should be run. The articles of incorporation are public records, but the corporate bylaws may not be available to the public. The bylaws exist solely to explain the business's internal operations.

Corporate Bylaws Template

When incorporating your business, a corporate bylaws template can help you comply with state incorporation standards. Bylaw content is not always specified by states, but it's important to include the number of board directors and the process for amendment. In California, at least three board directors are required if there are more than three shareholders. Bylaws are recommended if third parties may want to review your company's operations, such as business interests, financial institutions, or legal authorities.

C Corporations are taxed independently from their shareholders, but they keep their profits and losses separate. The default standard for corporations is the C Corp according to the IRS. Other business entities also need to create their own bylaws.

While S corporations are different from C corporations, S corps are subject to the same corporate bylaw requirements. Corporate bylaws for both corporations are guidelines written by the state to protect the shareholders and the board of directors from liabilities. Limited Liability Companies (LLCs) are not required to create corporate bylaws.

However, some states mandate an alternative called the LLC operating agreement. An LLC operating agreement, much like bylaws, explains how the LLC is organized and run, as well as the responsibilities of the members. Despite the different names, LLC operating agreements are binding documents that protect business owners and interests.

How to Use a Corporate Bylaws Template

A corporate bylaws template should cover essential aspects common to most corporations and use technical terms. To ensure proper writing, include the following terms:

Incorporated State and Name, Shareholders, Annual Meeting, and Quorum, Board of Directors and Committees, Stocks and Dividends, and Amendments.

When incorporating a company, select an available name and include the corporation's location in the template. Shareholders are owners, and the bylaws should outline their voting rights and the minimum number required to vote. The board of directors is responsible for writing the bylaws and appointing members. The board can establish committees to assign responsibilities.

Define the class of stock and share type and denote how dividends will be handled. Bylaws can be amended with a majority vote by the board of directors, shareholders, or both. State laws are often flexible regarding bylaw amendments.

Comments

Post a Comment